Common stock dividend calculator

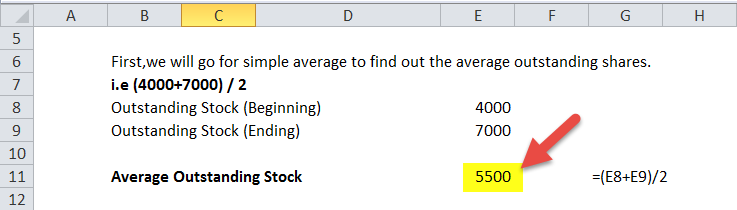

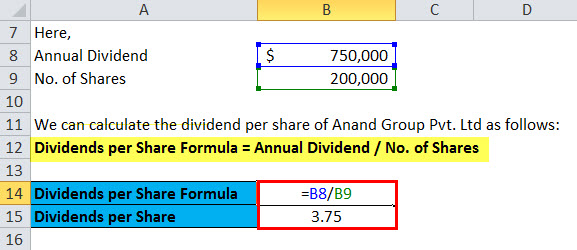

Here is the formula for calculating dividends. The company 200000 shares outstanding in its balance sheet.

Stock Total Return And Dividend Calculator

Annual net income minus net change in retained earnings dividends paid.

. For example if there are 10000 outstanding common shares of a company and each share has a par value of 10 then the value of outstanding share amounts to 100000. Dividends per Share Formula Annual Dividend No. Formerly SBC Communications Inc.

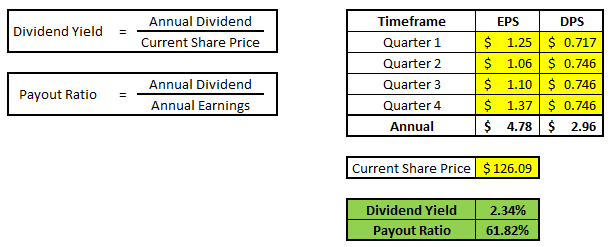

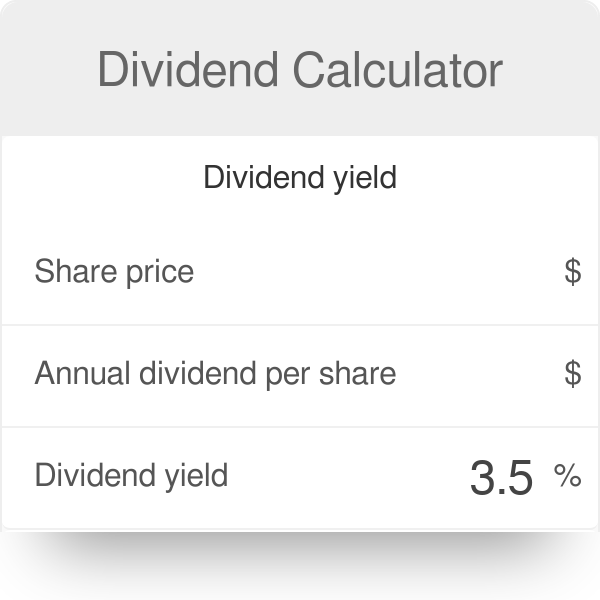

If a share of stock is selling for 35 and the company pays 2 a year in dividends its yield is 57. DRIPs allow investors the choice to reinvest the cash dividend and buy shares of the companys stock. How to Calculate the Value of Stocks.

How to Calculate Dividends per Share Here is the formula for calculating dividends per share. See our Historical Stock Information page for information on splits. How to Calculate the Value of Stocks To determine the value of common stock using the dividend growth model you first determine the future dividend by multiplying the current dividend by the decimal equivalent of the growth percentage dividend x 1 growth rate.

Common stock Total EquityTreasury stock-Additional paid-incapital-preferred stock-Retained earnings Common stock45000000020000000-150000000-10000000-50000000260000000 So after calculation common stock of the company remains at 260000000. Accumulated principal is 6720. If an investor holds 500 shares of a stock of a.

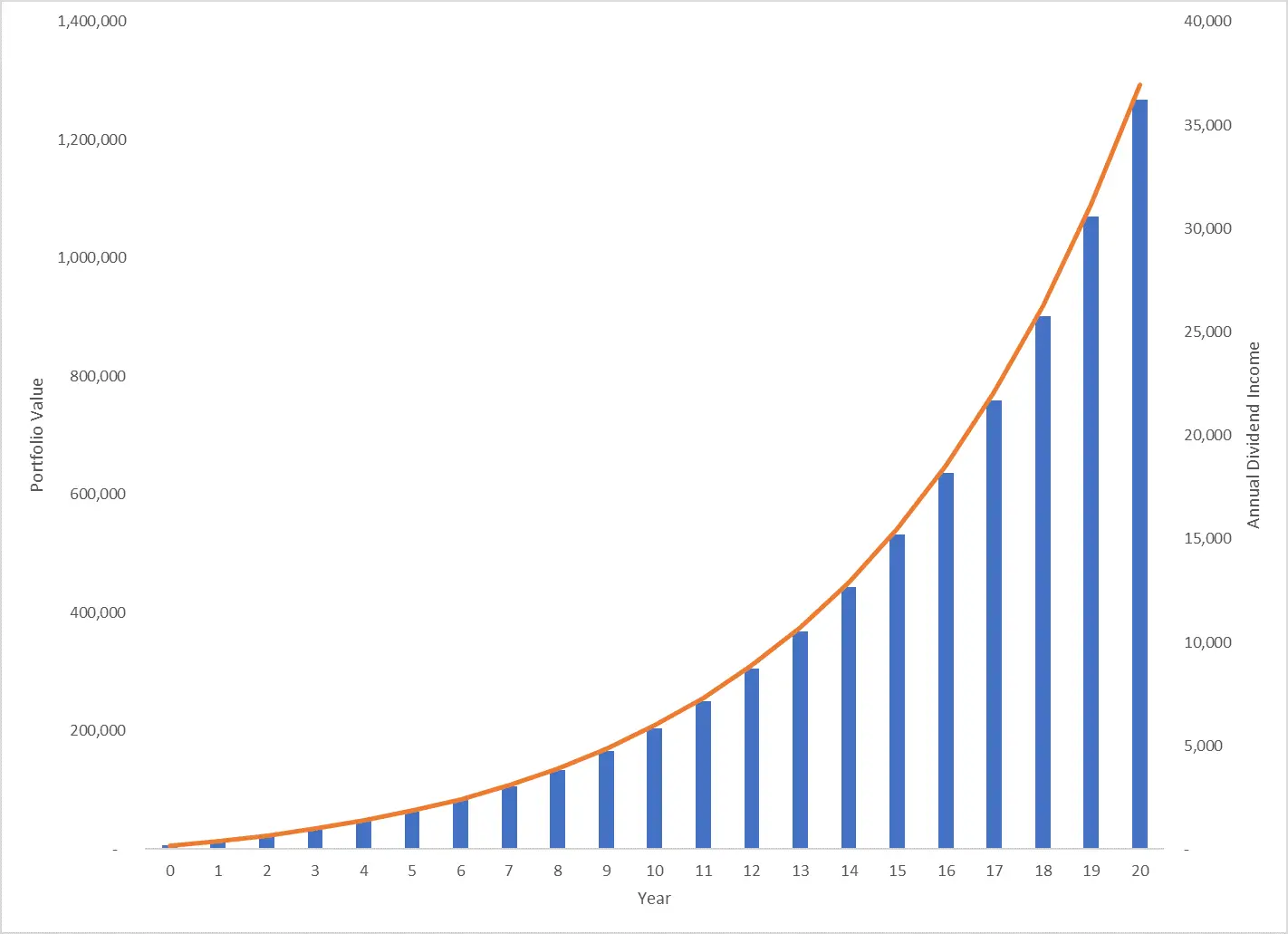

Calculator Share price x Number of shares Investment amount Holding period years i Expected dividend yield i Distribution frequency Quarterly i Annual contribution i Dividend tax rate i Expected annual dividend increase i Expected annual share price increase i DRIP Dividend Reinvestment Plan Without DRIP i. Stock Price Growth Rate Annual Number of Years. If you invest in stocks you may receive some dividends which are payments made to shareholders in correlation with how the stock is performing on the market.

Preferred Stock is a class of ownership in a corporation that has a higher claim on its assets and earnings than common stock is calculated using Preferred Stock Dividend Discount RateTo calculate Preferred Stock you need Dividend D Discount Rate rWith our tool you need to enter the respective value for Dividend Discount Rate and hit the calculate button. Ad Were all about helping you get more from your money. Additionally the calculator assumes all shares were purchased on a single.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. The formula for calculating the book value per share of common stock is. The original stock price for the year was 28.

A dividend is a reward to shareholders which can come in the form of a cash payment that is paid via a check or a direct deposit to investors. How to Use a Stock Dividend Calculator Determine Number of Stocks Look Up Current Stock Price Per Share Look up the Dividend Yield Multiply Those Numbers to Find the Annual Payout Divide that Number into Quarters What is a Stock Dividend. Dividend Per Share Total Dividends Paid Shares Outstanding or Dividend Per Share Earnings Per Share x Dividend Payout Ratio Enter your name and email in the form below and download the free template now.

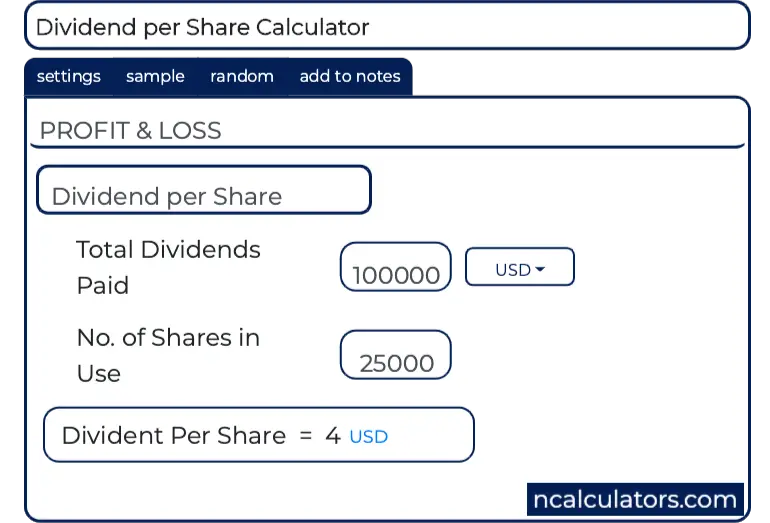

Dividend per share 750000 200000. The formula for calculating dividend per share has two variations. If the dividend stays the same then stock price and dividend yield have an inverse relationship.

Book value per share Stockholders equity Total number of outstanding common stock. The total return is 2055 giving an annual return of 118. If an individual investor wants to calculate their return on the stock based on dividends earned he or she would divide 112 by 28.

An example of the dividend yield formula would be a stock that has paid total annual dividends per share of 112. As you probably already know a share of stock is a share of ownership in a company. We can calculate Dividend per share by simply dividing the total dividend to the shares outstanding.

When a companys stock price goes up the dividend yield goes down. Shareholders can calculate the dividends on shares they own by multiplying the dividend-per-share by the number of shares in their portfolio. Find out just how much your money can grow by plugging values into our Compounding Returns Calculator below.

Southwestern Bell Corporation common stock and not obtained through an exchange from prior acquisitions. Dividend yield is a formula-based expression comparing the price of. Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account.

Common Stock can be calculated using the formula given below Common Stock Total Equity Preferred Stock Additional Paid-in Capital Retained Earnings Treasury Stock Common Stock 1000000 300000 200000 100000 100000 Common Stock 500000 Therefore FGH Ltds common stock stood at 500000 as on December 31 2018. What can the dividend yield tell me about a company. Ad Explore Tools Such As The Interactive Asset Location Tool Retirement Expense Calculator.

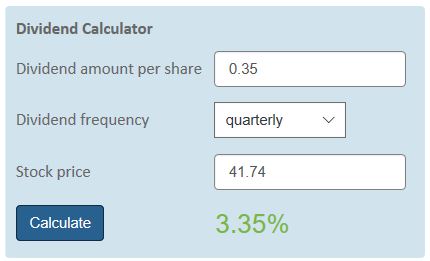

Build Your Future With a Firm that has 85 Years of Investment Experience. Using net income and retained earnings to calculate dividends paid To figure. Dividend Yield Annual Dividend Current Stock Price.

Ad Walk into the Future Confidently. Lets get started today. Dividend per share 375 dividends per share.

Calculator assumes all shares purchased were ATT Inc. The total accumulated dollars due to dividends is 8555. Find a Dedicated Financial Advisor Now.

However the shares are bought from the companies directly. Put simply the dividend yield shows how much a company pays out in dividends over the course of a. Discover Which Investments Align with Your Financial Goals.

DPS Dividends Paid Number of Shares Dividends per share can be found in the financial statement as dividends that have recently been paid out. To see if youre getting a good dividend in comparison to other stocks youll need to learn how to calculate dividend yield. Dividend Reinvestment Calculator As of 09082022.

Jacksons Assessment Tools Can Help Kickstart A More Meaningful Conversation With Clients. Use the formula Dividend Yield Current Annual Dividend Per ShareCurrent Stock Price to get the dividend yield. To get to the amount of dividends paid you must add up all the dividends that have been paid in one year.

Dividend Growth Rate Annual Beginning Stock Price. Have you ever wondered how much money you could. Have you ever wondered how much money you could make by investing a small sum in dividend-paying stocks.

Dividend Yield Calculator

Common Stock Formula Calculator Examples With Excel Template

Dividend Yield Definition Formula Investor Application

Common Stock Formula Calculator Examples With Excel Template

Dividends Per Share Meaning Formula Calculate Dps

Dividend Yield Formula And Calculator Excel Template

Common Stock Formula Calculator Examples With Excel Template

Free Dividend Calculator Achieve Your Retirement Goals

Present Value Of Stock With Constant Growth Formula With Calculator

Dividend Payout Ratio Formula Calculator Excel Template

Simple Excel Dividend Calculator For Metrics Like Yield And Payout Ratio

/dotdash_INV_final_Are_Marginal_Costs_Fixed_or_Variable_Costs_Jan_2021-012-68155744a01745e5be2659d6efee6ef9.jpg)

Do I Receive The Posted Dividend Yield Every Quarter

Dividends Per Share Formula Calculator Excel Template

Dividend Per Share Dps Calculator

Dividends Per Share Formula Calculator Excel Template

Dividend Calculator Definition Example

Dividend Yield Formula And Calculator Excel Template